Diagrams and examples are used to explain bond types, risks, and methods for calculating yields.

What is a bond?

A bond is a certificate of debt issued by a state, local government, or company to raise funds. If the issuer is a country, it is called a government bond, if it is a local government, it is a municipal bond, and if it is a company, it is called a corporate bond.In addition, it is called redemption to return the deed of the debt that you have and to cash it.

Bond investment is the purchase of these bonds and trying to make money by the price difference and interest rate from the time of purchase at the time of redemption a few years later.

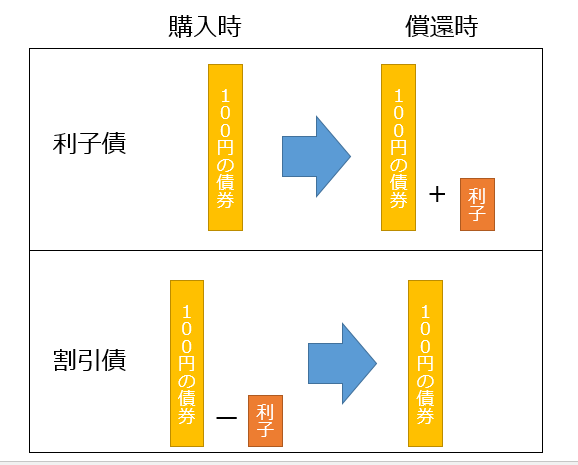

Interest-attached bonds and discounted bonds

Bonds can be divided into two types depending on how interest is received:

- Interest bonds: Bonds that can receive interest at a set time every year

- Discounted bonds: Bonds that do not have interest payments and can be purchased after the equivalent of interest

Risks of bonds

Investments see the expected magnitude of price fluctuations as risks.Basically, risk and return are proportional.

Risks in bonds include:

Credit Risk: Risk that bond issuer will not be able to pay the source interest

In the case of corporate bonds, it means the so-called risk of bankruptcy, where companies cannot pay interest to the face value of the bond promised to the purchaser of the bond.

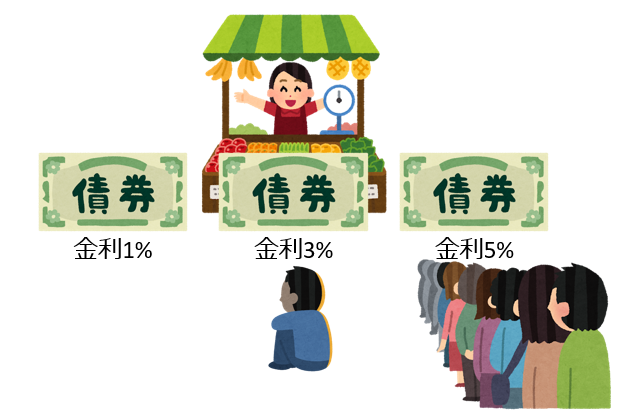

Risk of price fluctuations: The risk of price fluctuations in bonds due to market interest rates

One of the factors that causes the price of bonds to fluctuate is the fluctuation in interest rates in the world. In general, when interest rates in the world rise, the price of bonds issued when interest rates are low tends to go down.

For example, let’s say you issue a bond with an interest rate of 1%, and then you issue a bond with an interest rate of 5% because the world’s interest rate has risen.In this case, the price will fall because no one wants to buy a 1% interest bond because people of course pay attention to the bond with an interest rate of 5%.

Liquidity risk: Risk of not being able to trade at a reasonable price for the symbol

Whether the bond is issued a large or small amount, or whether the bond is popular or low, means the risk of not selling at the price you want to sell. Even if you want to sell a bond before maturity and cash it, you can’t sell it if few people want to buy it.

For example, bonds of companies that are likely to go bankrupt, bonds with lower interest rates than others shown in the example above, and bonds with lower trading volumes and unable to trade at reasonable prices, are forced to trade at lower prices than usual.

Risk of Foreign Exchange Fluctuations: Risks due to Currency Fluctuations

Occurs when a bond is purchased in a foreign currency.This means that there is a risk of loss when you receive interest or redemption money in foreign currency and convert foreign currency into yen.

Country Risk: Risk of lower bond prices due to instability in countries issuing bonds

This means that there is a danger that the price of government bonds will fall due to political insanity, fiscal deterioration, and war in the countries that issue bonds.

Reimbursement risk: Risk of change in operating period due to cancellation of purchases or deferred redemptions before the redemption deadline

It means the risk that funds invested in the middle of the planned investment period will be returned.In that case, you will not be able to receive interest that should have been obtained by the maturity date.

Foreign bonds related to Japan

Samurai Bonds: Bonds issued in yen by foreign issuers in Japan

Shogun Bonds: Bonds issued in foreign currency by foreign issuers in Japan

Euro-yen bonds: Bonds issued in yen by foreign issuers outside of Japan

It is called “euro yen bonds” because most of them are issued in the euro market.

Calculating bond yields

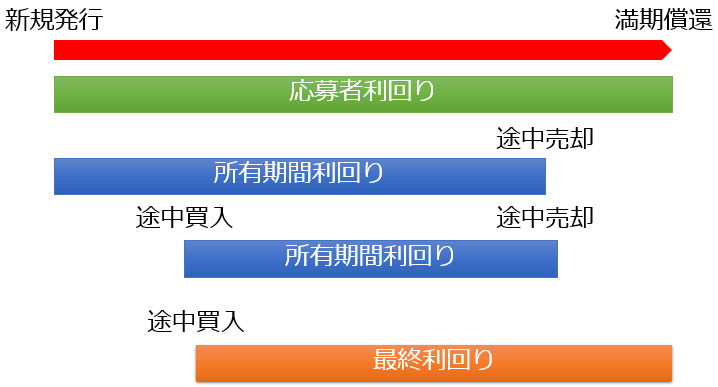

Depending on the difference in the ownership period, the yield of the bond can be called the applicant yield, the ownership period yield, and the final yield.

- Applicant yield: Newly issued bonds held up to maturity period

- Ownership yield: Purchase a new or out-of-the-box bond and sell it in the middle

- Final yield: If you purchase a issued bond and hold it until the redemption period

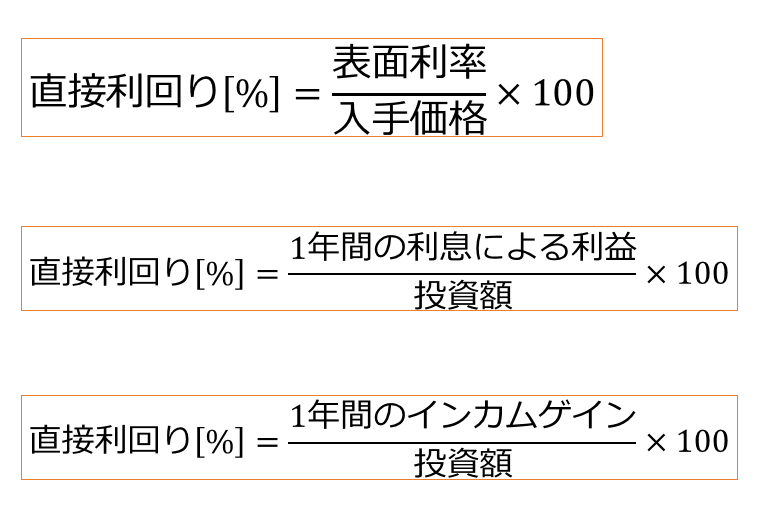

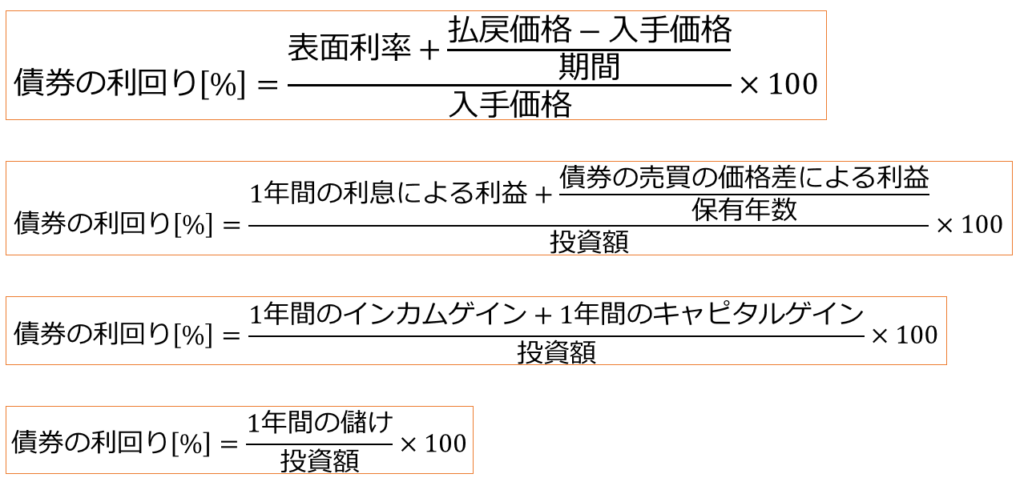

The formula for each yield can be applied in any case, as remembered in the following concepts: In the figure below, bond yields are expressed in various ways by varying the degree of abstraction. It is the top formula to use in the actual FP2 class qualification test, etc., but if you forget this formula, you will be able to reach this formula if you know the meaning of the yield.

In addition, the direct yield is represented as shown below. Direct yield is a percentage that does not take into account the price difference at the time of the sale of the bond, but only the interest paid per year on the investment amount.