I will explain futures trading, option trading, and swap trading which are derivatives (financial derivatives) in an easy-to-understand manner. The purpose is to understand why such a difficult thing exists, and to remember the image of each outline.

The Meaning of Derivatives

Derivative is a financial instrument derived from trading such as stocks and bonds.

The basic reason for the existence of derivatives is risk hedging. In addition to regular transactions, derivatives can be thought of as derivatives with a mechanism to avoid large losses.

It is considered to be a transaction made up of motivation to make a stable transaction even if you pay a little more than usual, and motivation to be able to hope for a higher profit even if the risk increases.

There are three typical types of derivatives:

- Futures trading

- Option trading

- Swaps trading

How futures trading works

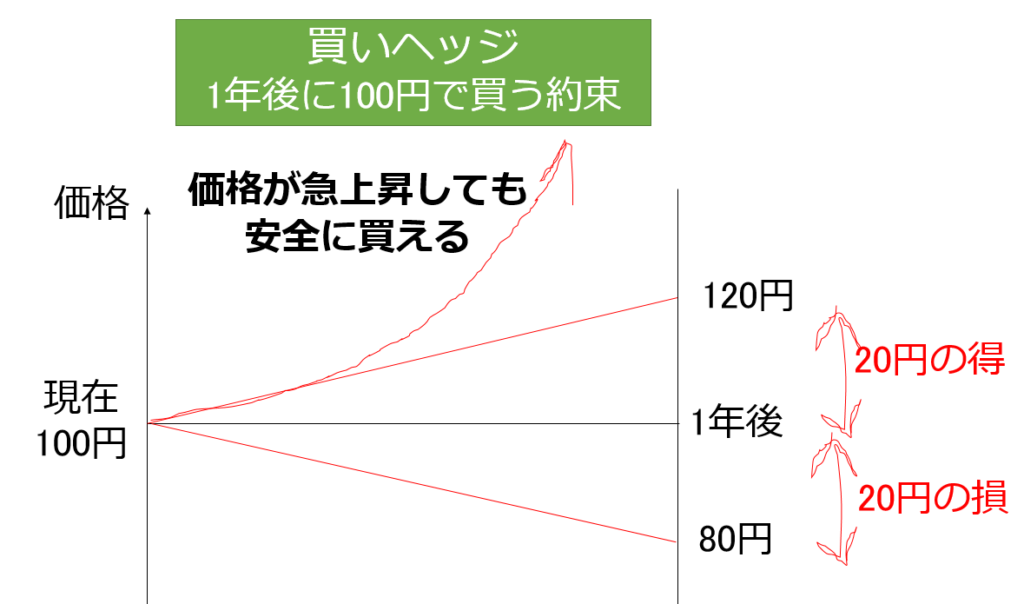

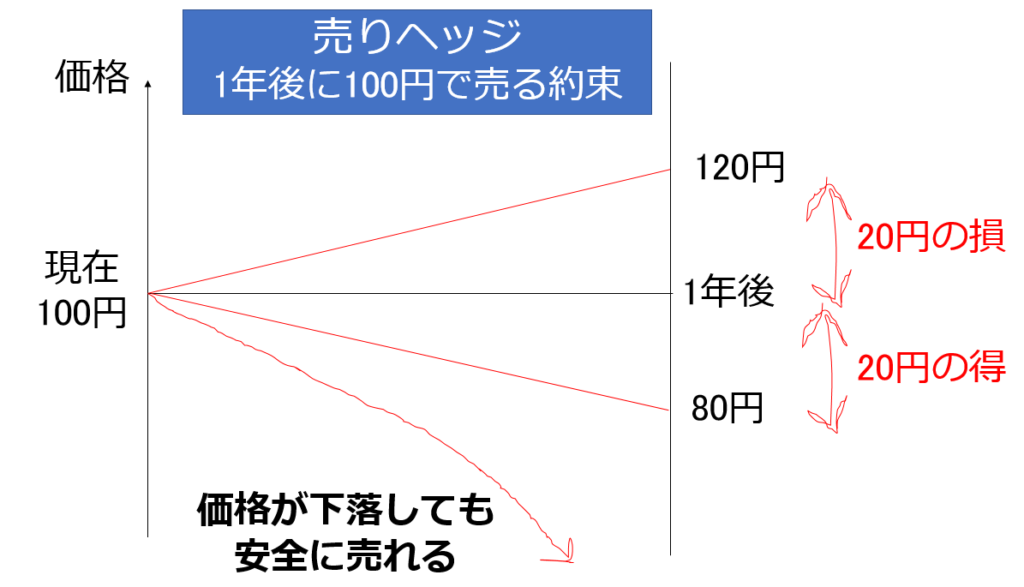

Futures trading is a transaction that promises to buy or sell a particular asset on certain terms at some time in the future. By using futures trading, you can avoid the risk of price fluctuations. There are sell hedges to prepare for the risk of falling prices and buy hedges to prepare for the risk of price increases.

The significance of the original futures trading is that it prepares for a sudden change in the price by determining the price of buying and selling in a few years, so it does not pay attention to some profit or loss due to small price changes. Therefore, for both the side that promised to buy and sell, and for the side that was made, it will be a win-win transaction due to the promise of stability of future buying and selling.

However, if you consider this to be a kind of money game or gambling called investment, it will be a game that bet money that profit and loss will be generated depending on how much the forecast of future price change is hit. This is because it is common in today’s investment world.

How option trading work

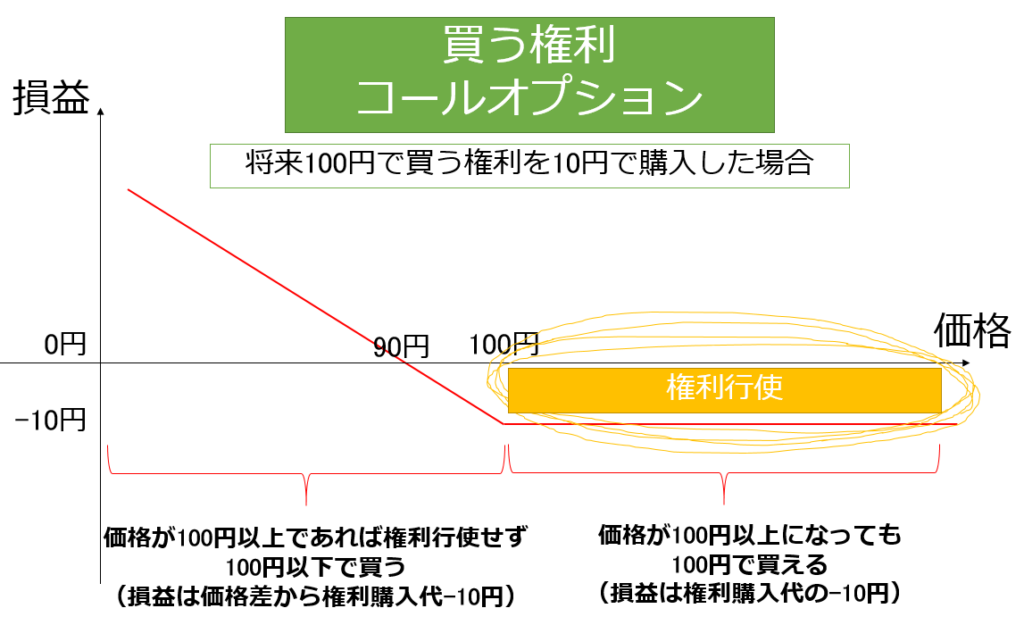

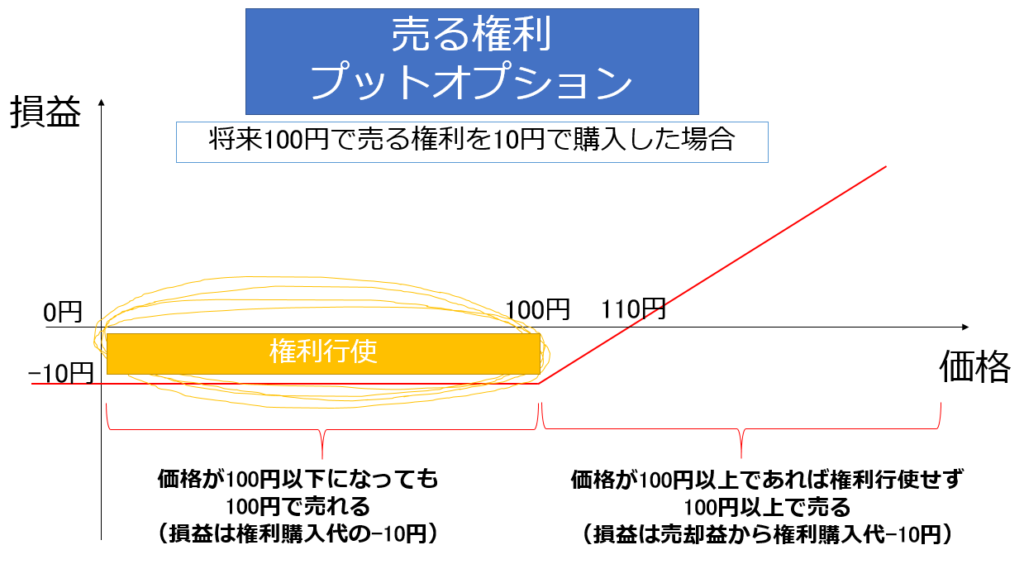

An option transaction is a transaction in which a particular asset is bought or sold at a specified price within a specified period of time (call option) and the right to sell (put option).

It can be regarded as “a promise about the terms and conditions of sale that may or may not be used” Buying an option always reduces the purchase price of the option, but in some situations you can reduce the loss.

classification by the timing at which the right can be exercised (the use of the right)

- American Type: Exercise rights at any time until the last day of trading

- European type: exercise rights only on maturity dates

It may be a good image to remember that America – the Statue of Liberty – a free country – you can exercise your rights at any time.

Classification by the market in which the option is traded

- Listing Options: Listed and Traded on Financial Instruments Exchanges

- Over-the-counter options: traded individually relative to each other

Listing options have the advantage of high safety and liquidity of settlement, but also have disadvantages that there are trading conditions and complicated procedures.

How swap trading work

Swap transactions are transactions that exchange “the right to receive money” or “obligation to pay money”.

Swap means exchange, and if the exchange target is interest rate, it is called interest rate swap, and if it is a different currency, it is called currency swap.

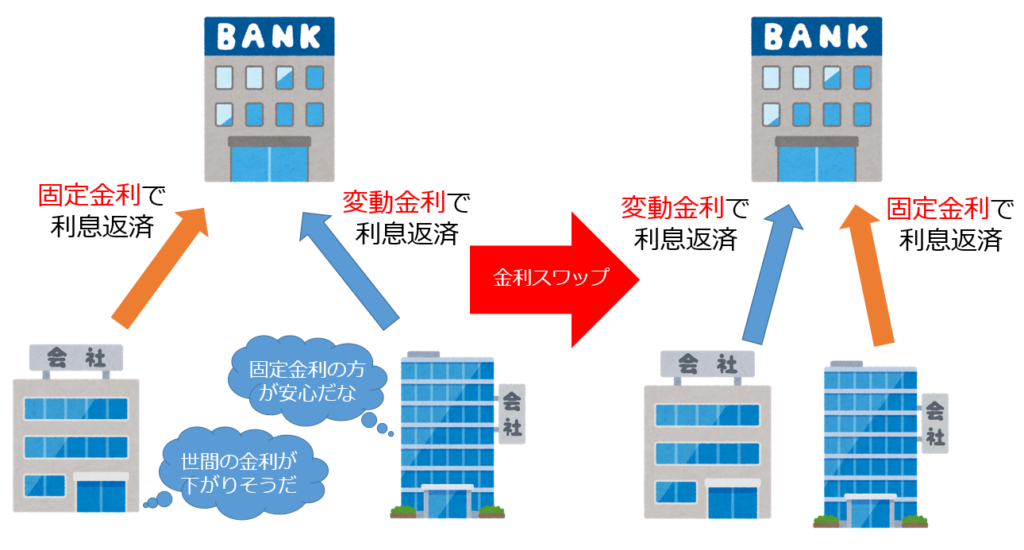

Interest rate swaps

Interest rate swaps exchange the receiving and payment of different interest rates in the same currency. In interest rate swaps, only the interest rate portion is exchanged.

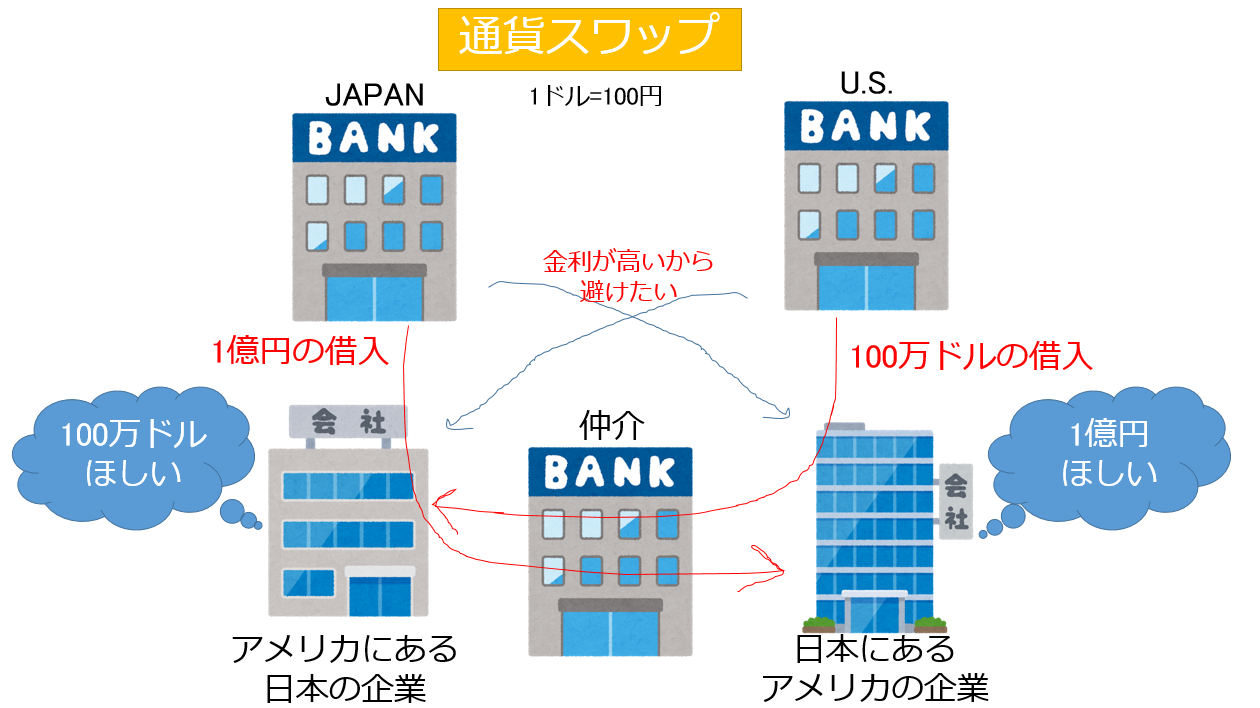

Currency Swaps

Currency swaps are exchanged for the receiving and payment of interest rates with the main accounts of different currencies. Both the original part and the interest rate part are exchanged.

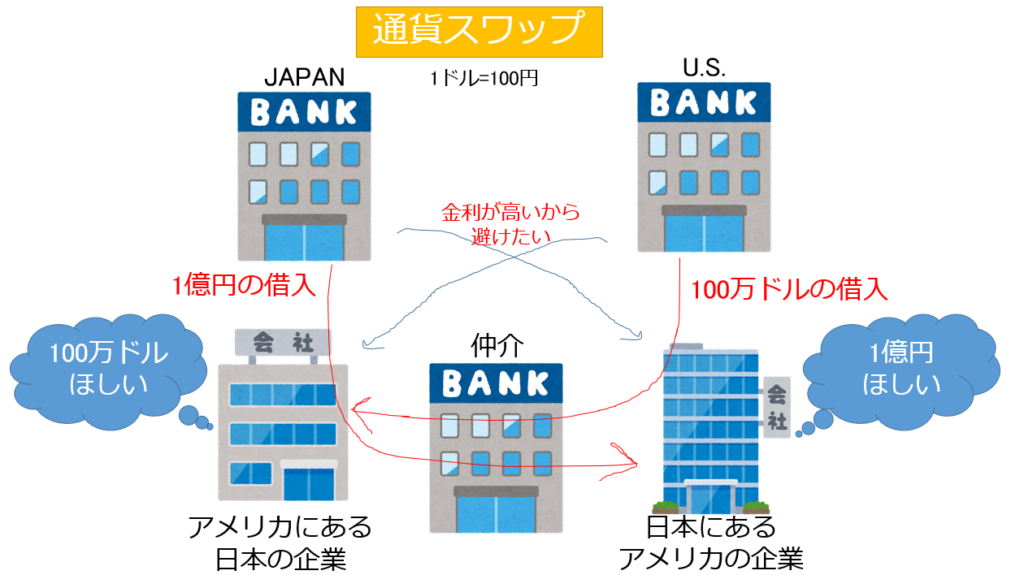

Currency swaps are used to procure foreign currency, as shown in the example shown above.

Why don’t American companies in Japan raise funds directly from Japanese banks?

This is because foreign companies are more at risk of bank lending and higher interest rates than domestic companies. Companies can raise money at a lower interest rate if they borrow at their own bank.

The figure above shows an example of a currency swap in which two companies borrow their currencies from their own banks at low interest rates and mediate foreign currencies through the mediation of another bank.